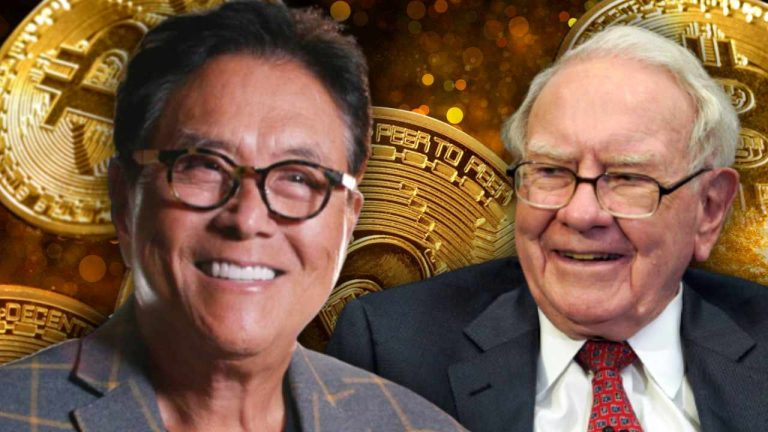

Robert Kiyosaki Shares His Investment Strategy — Says He’s Not Trying to Be Warren Buffett

Rich Dad Poor Dad author Robert Kiyosaki has revealed his investment strategy, emphasizing its divergence from the investment approach adopted by Berkshire Hathaway CEO Warren Buffett. “I am an average investor ‘accumulating’ the asset I want for the long term. I have been accumulating gold, silver, bitcoin, and real estate for years,” the famous author detailed.

Robert Kiyosaki Differentiates His Investment Strategy From Warren Buffett’s

The author of Rich Dad Poor Dad, Robert Kiyosaki, has outlined his investment strategy, underscoring its divergence from the approach adopted by investing legend Warren Buffett. Rich Dad Poor Dad is a 1997 book co-authored by Kiyosaki and Sharon Lechter. It has been on the New York Times Best Seller List for over six years. More than 32 million copies of the book have been sold in over 51 languages across more than 109 countries.

Kiyosaki wrote on social media platform X Sunday:

Rather than pretend to be Warren Buffett picking bottoms I am an average investor ‘accumulating’ the asset I want for the long term. I have been accumulating gold, silver, bitcoin, and real estate for years.

“My first gold coin cost $50. Today that same coin is worth $2,000. You can become rich by being an average investor, using dollar cost averaging to get rich. Take care,” he added. “Gold dropped $10 today. Silver 14 cents. This is where ‘dollar cost averaging’ pays off.”

Buffett is a proponent of value investing. He previously explained that the secret of his investing success is to make “investments in businesses with both long-lasting favorable economic characteristics and trustworthy managers.” The Berkshire Hathaway CEO also previously said: “When buying companies or common stocks, we look for first-class businesses accompanied by first-class management.”

Kiyosaki has been recommending investors buy gold silver, and bitcoin for quite some time. Last week, he said the price of BTC is headed for $135,000 while gold will soon break through $2,100 and then take off. In addition, he said silver will increase from $23 to $68 an ounce.

The Rich Dad Poor Dad author has made several predictions regarding the prices of bitcoin, gold, and silver. Back in August, he stated that should a global economic crisis occur, the price of bitcoin would surge to $1 million, with gold reaching $75,000, and silver climbing to $60,000. In February, he said that the price of BTC is expected to reach $500,000 by 2025, while gold is anticipated to climb to $5,000 and silver is projected to reach $500 within the same timeframe.

Unlike Kiyosaki, Buffett is not a fan of bitcoin. The Oracle of Omaha is famous for saying the cryptocurrency is “probably rat poison squared.” He said in April that BTC is a gambling token that doesn’t have any intrinsic value. In May last year, he said he wouldn’t pay $25 for all bitcoin in the world.

What do you think about Rich Dad Poor Dad author Robert Kiyosaki’s investment strategy? Do you prefer to follow Warren Buffett’s value investing strategy? Let us know in the comments section below.

Register now to receive up to $255 welcome bonus. Let cryptocurrency change your life UPDATED link: $255(Lbank) + $100(jhjhj444.gq). Register NOW!