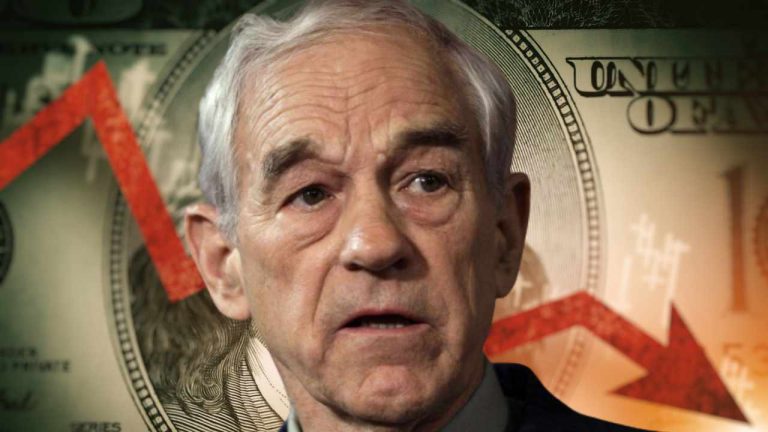

Ron Paul Warns Fiscal Responsibility Act Will Erode US Dollar Value, Hasten Loss of Reserve Currency Status

Former U.S. Representative Ron Paul has warned that the Fiscal Responsibility Act, recently signed into law by President Joe Biden, will escalate government spending, debt, and deficits. It will also erode the value of the U.S. dollar, “making it more likely that the U.S. dollar will lose its world reserve currency status sooner rather than later,” he cautioned.

Ron Paul Warns of U.S. Dollar Losing World Reserve Currency Status

Former U.S. Representative Ron Paul warned in an article published on the Ron Paul Institute website Monday that the Fiscal Responsibility Act (FRA) will have a number of negative consequences for the United States, including eroding the U.S. dollar’s dominance. Paul is an American author, physician, and retired politician. The former representative from Texas established The Ron Paul Liberty Report in 2015 to provide insightful opinions and analysis on current issues impacting our lives and finances.

President Joe Biden signed the Fiscal Responsibility Act of 2023 into law on Saturday after intense negotiations in Congress due to the looming possibility of the U.S. government defaulting on its debt obligations.

While the Act helps the U.S. avoid having to default on its debt on June 5, Paul stressed: “It allows the government to continue adding trillions of dollars of debt that will be monetized by the Federal Reserve.” The former congressman cautioned:

Of course, this default will be felt by the people in the form of an inflation tax. This inflation tax may be the worst of all taxes, because it is both hidden and regressive.

“Politicians love to point the finger at greedy corporations, labor unions, and even consumers for increasing prices instead of taking responsibility for the legislation they pass that incentivizes the Federal Reserve to create more inflation,” he continued.

Paul explained that Republican supporters of the bill claim it begins to roll back the excessive spending of the Biden years. However, “it does not save taxpayers a dime,” he asserted, noting that “It makes no attempt to actually cut spending, much less eradicate any illegitimate and unconstitutional government agencies, cabinet departments, or programs.”

Moreover, the former Texas representative detailed that “defense” is the third largest item in the budget, adding that “Biden’s military budget is the largest in United States history and probably world history.”

Paul opined: “Hawks alienate current and potential allies with their hyper-interventionist policies. This along with the increasing national debt is leading to increased challenges to the U.S. dollar’s status as the world’s reserve currency.”

Highlighting that the U.S. dollar’s global currency status “is the only reason Congress has been able to run up such a huge deficit without causing a major economic crisis,” Paul cautioned that besides escalating “government spending, debt, and deficits,” the Fiscal Responsibility Act will risk the U.S. dollar’s dominance. He stated:

It will also further erode the value of the United States dollar, thus making it more likely that the U.S. dollar will lose its world reserve currency status sooner rather than later.

Do you agree with Ron Paul? Let us know in the comments section below.

Register now to receive up to $255 welcome bonus. Let cryptocurrency change your life UPDATED link: $255(Lbank) + $100(jhjhj444.gq). Register NOW!